Are you a business owner looking to safeguard your investments? Have you ever wondered how much it would cost to insure your essential equipment?

The truth is, understanding business equipment insurance can be a game-changer for protecting your assets and ensuring peace of mind. This insurance isn’t just an expense—it’s a safety net that shields your business from unexpected financial setbacks. But how much does this protection really cost?

We’ll dive into the factors that influence the price of business equipment insurance. By the end, you’ll have a clearer picture of what to expect and how to make an informed decision that benefits your business. Ready to uncover the details? Let’s get started!

What Is Business Equipment Insurance

Business equipment insurance covers damages to essential tools and devices used by a company. Costs vary based on coverage limits and types of equipment, typically ranging from a few hundred to several thousand dollars annually.

Are you worried about the safety of your business equipment? Then understanding Business Equipment Insurance is crucial. This type of insurance protects the tools and machinery essential for your business operations. Whether you’re running a bustling café with expensive coffee machines or managing a construction site with heavy machinery, this insurance ensures you’re covered against unexpected mishaps. ###What Is Business Equipment Insurance?

Business Equipment Insurance is a policy designed to cover the cost of repairing or replacing your business equipment if it’s damaged, lost, or stolen. It shields the lifeline of your business operations. Imagine your computer systems crashing due to a power surge. Without insurance, the financial burden falls directly on you. But with Business Equipment Insurance, you can breathe easy knowing there’s coverage to help you bounce back swiftly. ###Why Is Business Equipment Insurance Important?

This insurance is vital because it helps mitigate financial losses. Equipment breakdowns can lead to operational downtime, affecting productivity and profit. By investing in this insurance, you safeguard your business’s continuity. Consider a scenario where your high-end equipment is stolen. The immediate cost of replacement can be overwhelming. Insurance eases this financial strain, allowing you to focus on maintaining business momentum. ###What Does Business Equipment Insurance Cover?

Coverage typically includes damage from accidents, theft, and even certain natural disasters. However, specifics can vary. Picture this: a sudden storm damages your outdoor equipment. With the right insurance, repair costs are covered, preventing unexpected expenses from derailing your budget. ###How To Choose The Right Policy?

Choosing the right policy involves evaluating your business’s specific needs. Consider the value of your equipment and the risks it faces. Ask yourself: is your equipment prone to specific issues? If you run a tech company, your computers might be at risk. Tailoring your policy to cover such vulnerabilities ensures your peace of mind. ###Can You Afford To Ignore It?

Ignoring Business Equipment Insurance might seem tempting to cut costs. But what happens if disaster strikes? The financial repercussions could be far greater than any savings. If a major equipment failure halted your business, could you recover without insurance? This coverage isn’t just a safety net; it’s a strategic investment in your business’s future.

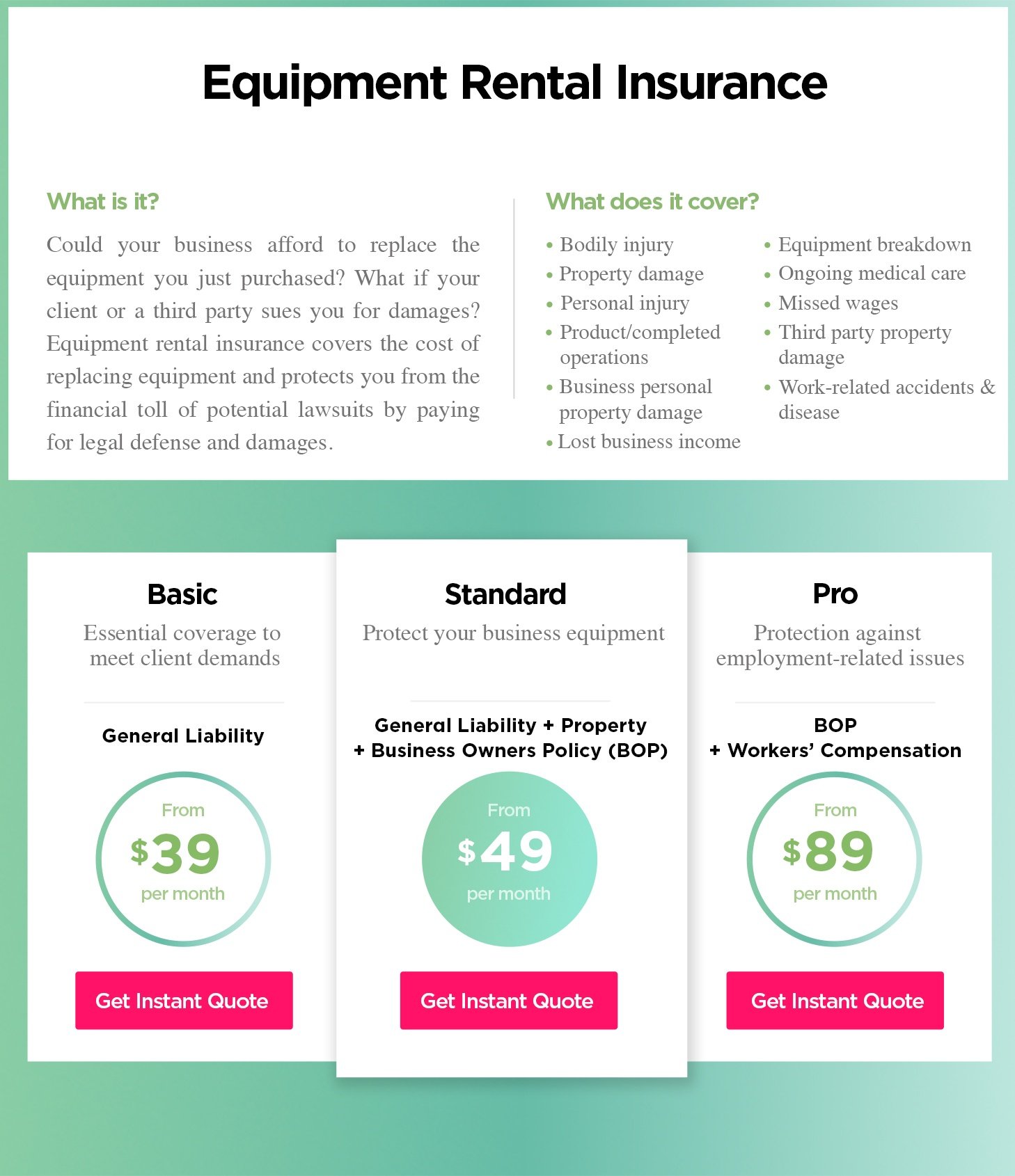

Credit: coterieinsurance.com

Importance Of Business Equipment Insurance

Business equipment insurance is a crucial safety net for any company, regardless of size or industry. Imagine waking up one morning to find your essential machinery damaged or stolen. The financial impact can be devastating. That’s why understanding the importance of business equipment insurance is vital to safeguarding your business assets and operations.

Protection Against Loss

Picture this: a sudden electrical surge renders your computers useless. Without business equipment insurance, replacing them could drain your resources. Insurance provides a financial buffer, covering repair or replacement costs.

Consider the peace of mind you’ll gain knowing that unexpected disasters won’t cripple your operations. Having coverage means your business can weather unforeseen challenges without taking a financial hit. Isn’t that worth the investment?

Safeguarding Business Operations

Business continuity is crucial. Equipment failures can disrupt your services, impacting clients and revenue. Insurance helps you get back on track quickly, minimizing downtime.

Think about how much smoother your operations run when you know equipment breakdowns won’t halt your progress. With insurance, you ensure your business keeps moving forward, even when the unexpected happens.

Have you ever calculated the cost of downtime? Business equipment insurance ensures that your operations remain uninterrupted, safeguarding your bottom line.

In a world where unpredictability is the only constant, business equipment insurance is not just a precaution—it’s a necessity. Protecting your assets and ensuring seamless operations is a wise choice for any business owner. Don’t wait for a crisis to realize its value.

Factors Influencing Insurance Costs

Business equipment insurance costs vary based on several factors. Coverage limits, equipment type, and location significantly affect premiums. Understanding these factors helps determine how much you might pay.

When considering business equipment insurance, understanding the factors that influence its cost is crucial. These factors can significantly impact your budget, so being informed can help you make better financial decisions. Let’s break down the key elements that play a role in determining the cost of your business equipment insurance.Type Of Equipment

The type of equipment you need to insure can greatly affect the price of your policy. High-tech or specialized equipment often demands higher premiums due to their replacement or repair costs. Consider a tech startup versus a small café; the former’s servers and computers might cost more to insure than the latter’s coffee machines. An interesting insight is that older equipment might not always be cheaper to insure. While it may cost less to replace, it could be more prone to malfunctions, increasing the likelihood of claims. So, keep in mind that the equipment’s age and technology level can sway your insurance costs.Business Size And Industry

The size of your business and the industry you’re in can also influence insurance costs. Larger businesses often have more equipment, leading to higher insurance expenses. However, they might also benefit from volume discounts or better rates due to their bargaining power. Industry matters too. If you’re in a high-risk field, like construction or manufacturing, insurers might charge more due to the increased chances of equipment damage. On the other hand, a boutique marketing firm might enjoy lower costs due to the less risky nature of its equipment.Location And Risks

Where your business operates can significantly impact your insurance premiums. Areas prone to natural disasters, such as floods or earthquakes, can lead to higher costs due to the increased risk of damage. Imagine setting up a shop in a flood-prone zone; your insurance costs might spike because of the potential for water damage. Moreover, local crime rates can also affect your insurance. If your business is in an area with a high rate of theft or vandalism, insurers might see your equipment as more vulnerable and adjust the rates accordingly. Have you considered how your business location might be influencing your insurance costs? Understanding these factors can empower you to make informed decisions about your business equipment insurance. Keep these insights in mind as you explore your options, ensuring you choose the best coverage for your unique situation.Average Cost Of Business Equipment Insurance

Business equipment insurance is a crucial consideration for any entrepreneur looking to safeguard their assets. But how much does it really cost? The average cost can vary significantly, influenced by factors like the size of your business, the industry you operate in, and the specific coverage you need. Understanding these elements can help you make an informed decision about what’s right for your business.

Small Vs. Large Businesses

Are you running a small local shop or a large corporation? The scale of your business impacts your insurance costs. Small businesses often find that their premiums are lower due to fewer assets and reduced risk exposure. Imagine owning a cozy bakery; you might pay less than a tech giant with expensive servers and equipment.

Large businesses, on the other hand, might face higher premiums. They typically own more equipment, and their potential risk factors are greater. Does your business have multiple locations or high-value machinery? These factors can increase your insurance costs but also ensure comprehensive protection.

Industry-specific Costs

Insurance costs can also hinge on your industry. Are you in construction, retail, or healthcare? Each sector has unique risks and equipment needs. A construction company might pay more due to the high-risk nature and expensive machinery involved.

In contrast, a retail business may have different considerations. Think about the equipment in a clothing store versus a medical clinic—each requires tailored coverage. Understanding your industry-specific risks can guide you in finding the most cost-effective insurance.

Do you know what your business needs for optimal protection? Exploring these factors and asking the right questions ensures you don’t overpay or underinsure. With the right approach, business equipment insurance can be a smart investment rather than a financial burden.

Ways To Lower Insurance Costs

Business equipment insurance can be costly, but there are ways to save. Lowering insurance costs can significantly impact your business budget. Exploring different strategies can help reduce your premiums without compromising coverage. Here are some effective methods to consider.

Bundling Policies

Bundling policies can provide significant savings on insurance costs. Combine your business equipment insurance with other policies. This could include general liability or property insurance. Insurance providers often offer discounts for bundled packages. This approach simplifies your insurance management and reduces overall premiums.

Increasing Deductibles

Increasing your deductibles can lower your insurance premiums. A higher deductible means you pay more out-of-pocket for claims. This reduces the insurer’s risk, often leading to lower premiums. Make sure the deductible is manageable for your business finances. Carefully evaluate the potential savings against the risk.

Implementing Safety Measures

Implementing safety measures can reduce your insurance costs. Insurers often offer discounts for businesses with robust safety protocols. Install security cameras, alarm systems, and fire extinguishers. Regularly maintain and inspect equipment to prevent accidents. These measures not only lower premiums but also protect your assets.

Credit: www.techinsurance.com

Comparing Insurance Providers

Choosing the right business equipment insurance provider is crucial. It affects both your coverage and cost. With numerous providers available, selecting the best one can be overwhelming. Proper comparison helps you secure the best deal. It ensures you get the most suitable coverage for your business needs. Consider factors such as coverage options, customer reviews, and overall reputation.

Evaluating Coverage Options

Coverage options vary among insurance providers. Some offer comprehensive protection, others more basic plans. It’s vital to assess what each policy includes. Look for coverage that aligns with your business needs. Some policies cover theft, damage, and loss. Others may include natural disasters or employee-related incidents. Review the terms carefully. Ensure you understand what is included or excluded.

Reading Customer Reviews

Customer reviews offer valuable insights into insurance providers. They reveal real experiences with claims, customer service, and policy renewals. Positive reviews often indicate reliable service and support. Negative reviews may highlight hidden costs or poor service. Read reviews from various sources for a balanced view. Look for patterns in feedback. Consistent complaints or praises can guide your decision-making process.

Steps To Obtain Business Equipment Insurance

Business equipment insurance protects your valuable assets. It’s crucial for any business. Securing the right policy involves several steps. This guide will help you navigate the process. Let’s start with assessing the value of your equipment.

Assessing Equipment Value

Begin by listing all your business equipment. Include computers, machinery, and tools. Note the purchase price of each item. Consider the current market value. This helps in determining coverage needs. Replacement costs might differ from purchase prices. Keep this in mind.

Document the condition of your equipment. Take photos if possible. This can aid in claims processing. Accurate documentation is key. Organize this information for easy access.

Consulting An Insurance Broker

Insurance brokers can offer valuable guidance. They understand the market and policies. A broker can help tailor coverage to your needs. Discuss your equipment list with them. They can suggest suitable insurance options.

Brokers have access to various insurers. They can compare policy features and prices. This ensures you get the best deal. Don’t hesitate to ask questions. Clarify any doubts about coverage and premiums.

Choosing the right broker is important. Look for experience and good reviews. A knowledgeable broker simplifies the process. They make obtaining business equipment insurance straightforward.

Credit: www.ez.insure

Frequently Asked Questions

What Is Business Equipment Insurance?

Business equipment insurance covers damage or loss of your business tools. It protects essential items like computers, furniture, and machinery. This insurance helps businesses recover financially from unexpected events. It is crucial for maintaining operations without significant financial strain.

How Much Does Business Equipment Insurance Cost?

The cost of business equipment insurance varies based on factors. These include coverage amount, business type, and location. Typically, it ranges from a few hundred to several thousand dollars annually. Comparing quotes from different insurers can help find the best price.

What Factors Affect Equipment Insurance Premiums?

Several factors influence equipment insurance premiums. These include the type of equipment, its value, and usage. The business location and claims history also play a role. Higher-risk businesses typically face higher premiums. Regularly reviewing these factors can help manage costs.

Is Business Equipment Insurance Mandatory?

Business equipment insurance is not mandatory by law. However, it is highly recommended for businesses. It protects against financial losses from equipment damage or theft. Some clients or contracts might require it as part of their agreement.

Conclusion

Business equipment insurance protects valuable assets from unexpected risks. Costs vary based on factors like equipment type and coverage level. Assess your business needs to choose the right plan. Research options and compare prices. Understanding insurance terms is crucial for informed decisions.

Consider consulting an expert for personalized advice. Coverage ensures peace of mind and financial security. Protect your equipment and keep business operations smooth. Investing in the right insurance plan can prevent costly losses. Prioritize safeguarding your equipment to focus on growing your business.

Make insurance a key part of your risk management strategy.